SkillsFuture for Businesses

by Arthur Yang November 3, 2023

Businesses enjoy more SkillsFuture benefits as compared to the individual.

Are you aware of all of them yet?

“SkillsFuture for Business” will go into the various funding subsidies that you can leverage on to grow your business!

Here’s a glimpse of what we’ll explore:

1. Why should you train your employees?

2. SkillsFuture Enterprise Credits

4. Course Fee Funding

3. Enhanced Training Support for SMEs

5. Absentee Payroll Funding

6. Conclusion

Let’s start!

SkillsFuture for Businesses

SkillsFuture for Businesses

SkillsFuture for Businesses

Why should you train your employees?

In today’s competitive business landscape, investing in upskilling for your workforce is imperative for staying ahead.

By sending your employees for upskilling courses, you empower them to adapt to technological advancements, boosting their productivity and the quality of their output.

Not only does this enhance their job satisfaction and loyalty, but it also fosters innovation, allowing your business to meet customer demands effectively.

In the context of Singapore, where SkillsFuture plays a pivotal role in shaping the nation’s workforce, aligning your upskilling initiatives with this vision is crucial.

It not only ensures compliance with regulations but also positions your company as an attractive employer for top talent.

Embracing SkillsFuture demonstrates your commitment to nurturing a skilled, adaptable workforce, essential for sustainable growth and global competitiveness.

By investing in your employees’ growth through SkillsFuture, you not only future-proof your business but also contribute to the nation’s goal of creating a highly skilled workforce.

It’s a strategic move that drives innovation, enhances customer satisfaction, and ultimately strengthens your company’s position in the market.

SkillsFuture Enterprise Credits

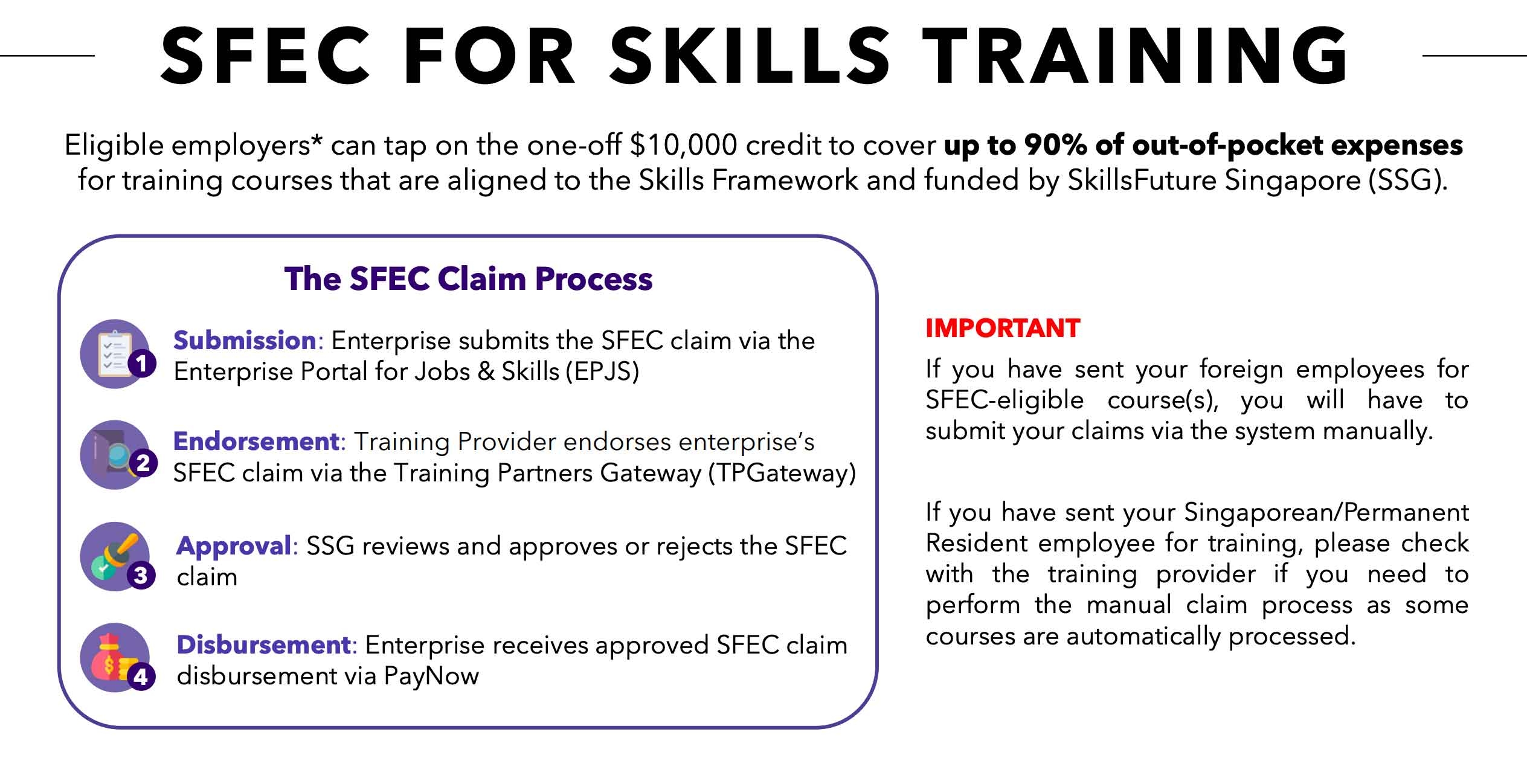

The SkillsFuture Enterprise Credits (SFEC) offers a one-off credit of S$10,000 to support businesses investing in enterprise and workforce transformation.

Qualifying businesses will be able to get up to 90% funding support for out-of-pocket expenses when they enrol in relevant programmes.

Enterprise SG will notify all newly eligible employers for SFEC via email sent to their registered CorpPass Administrators.

There is no need to apply separately for the SFEC.

However, employers have to meet the eligibility critieria for the individual SFEC-supported programmes before they can utilise the credit.

The SFEC supports two types of programmes — Enterprise Transformation and Workforce Transformation

#1 — Enterprise Transformation

Enterprise transformation includes schemes hosted on the Business Grant Portal (BGP).

Some of the supported programmes are:

– Productivity Solutions Grant (PSG)

– Enterprise Development Grant (EDG)

– Market Readiness Assistance (MRA) Grant

– Enterprise Leadership for Transformation Programme (ELT)

– Aviation Development Fund (ADF)

– Business Improvement Fund (BIF)

There is a cap of S$7,000 on the credit that can be used for initiatives under enterprise transformation.

#2 — Workforce Transformation

Under workplace transformation, programmes include initiatives for redesigning jobs and carefully crafted training programs offered by SkillsFuture Singapore and Workforce Singapore.

These programmes encompass training courses that align with the Skills Framework, Career Conversion Programmes, and sector-specific training initiatives.

SFEC-supported programmes include:

– Singapore Global Executive Programme

– Skills Framework-aligned courses

– National Centre of Excellence for Workplace Learning (NACE) Training Programmes

– National Centre of Excellence for Workplace Learning (NACE) Consultancy Services

– Career Conversion Programmes

– Employment Support for Persons with Disabilities (PwDs) – Job Redesign Grant for Employers

– Training Industry Professionals in Tourism (TIP-iT)

Unlike the enterprise transformation, there is no cap on credit that can be used for workforce transformation.

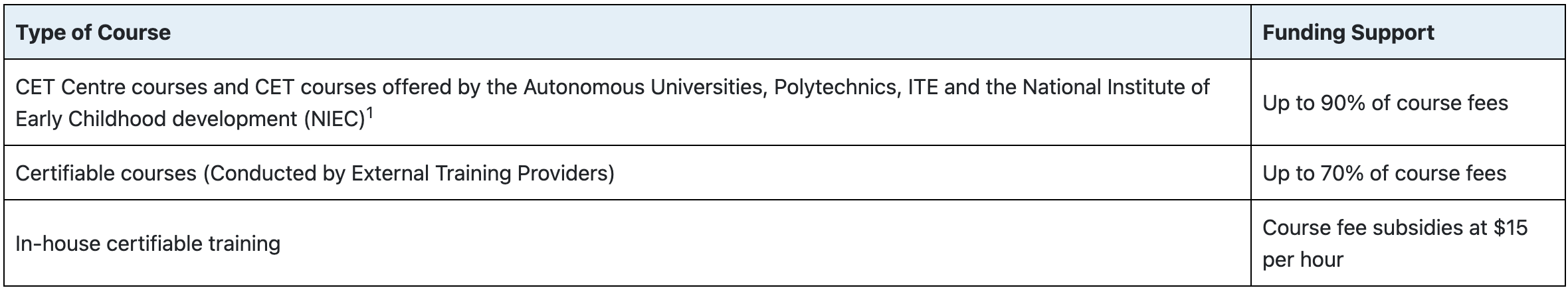

Course Funding

Employers can benefit from reduced training costs by sponsoring their Singapore Citizen, Permanent Resident, and Long Term Visitor Pass Plus (LTVP+) employees for SSG-funded training courses.

Through this initiative, you can receive a subsidy of up to 70% for courses offered by SSG-appointed CET Centres and up to 50% for certifiable courses approved by SSG.

To qualify, your organisation must be registered or incorporated in Singapore.

Additionally, non-business entities like Voluntary Welfare Organisations (VWOs) and societies, along with eligible sole proprietorships, can also take advantage of these subsidies

Learn more about the detailed funding breakdown here.

Enhanced Training Support for SMEs

The Enhanced Training Support for SMEs (ETSS) provides additional assistance to SMEs by offering increased subsidies for course fees.

SMEs can benefit from SkillsFuture funding, covering up to 90% of the course fees when they send their employees for SSG-supported courses.

To qualify, SMEs must meet the following criteria:

- Registered or incorporated in Singapore

- Employment size of not more than 200 or with annual sales turnover of not more than $100 million

In addition, trainees sponsered should meet the below requirements.

- Must be Singapore Citizens or Singapore Permanent Residents.

- Courses have to be fully paid for by the employer.

- Trainee is not a full-time national serviceman.

Absentee Payroll Funding

Absentee Payroll (AP) funding is a grant designed to offset some of the manpower expenses incurred when you enroll your Singaporean and Permanent Resident employees in SSG-funded training programs.

For Singaporeans and Permanent Residents:

- AP funding rate: A fixed amount of S$4.50 per hour

- Each organization’s cap: S$100,000 per calendar year

For Singapore Citizens aged 30 and above (or Persons with Special Needs aged 13 and above) earning a monthly salary of ≤$2,500 (under the Workfare Skills Support program):

- 95% of hourly basic salary, capped at $13 per hour

To claim AP funding, you need to provide your employees’ hourly salary details (pre-CPF deduction) on the Enterprise Portal for Jobs and Skills.

All claim services are accessible on the AP funding page, with disbursement made via PayNow within two and a half weeks after submitting the AP Declaration

Conclusions

. . . . .